Sales & Use Tax 101 Series: Introduction

Navigating the complexities of sales and use tax can be challenging for any business owner. This blog aims to provide a foundational understanding of these taxes and offer a framework for considering their impact on your business. This is the first of a four part series on sales and use tax.

What is Sales Tax?

Sales tax is a tax levied on the sale of goods and services by state and/or local governments. The application of sales tax to specific transactions depends on the regulations of the state and local authorities imposing the tax.

What is Use Tax?

Use tax applies to goods and services purchased outside the state but used within the state. It serves as a counterpart to sales tax, ensuring that out-of-state purchases are taxed similarly to in-state purchases.

“Quick Tip #1: As complementary taxes, either sales or use tax is paid on a particular transaction, not both. States generally have rules that give a taxpayer credit for sales or use tax paid elsewhere so as not to duplicate tax on the same transaction. ”

The Role of These Taxes in the Broader Tax System

In the United States, taxes are imposed by federal, state, and local governments. While the federal government primarily imposes income taxes, state and local governments may levy a variety of taxes, including income, sales, use, property, and excise taxes.

Why Sales & Use Tax Matter for Business Owners

As a business owner, even if you operate online from home, you may have sales and/or use tax obligations. Familiarizing yourself with these taxes is crucial to ensure compliance and avoid potential penalties. Knowing what to look for and how to manage these obligations can save you time and resources.

“Quick Tip #2: Sales tax is typically imposed on and paid by the customer, with the seller having a collection and remittance obligation to the state taxing authority. If a seller does not charge sales tax to the customer, it can end up a liability of the seller with the tax amount (and, in some cases, penalty) ultimately coming out of the bottom line of the seller.”

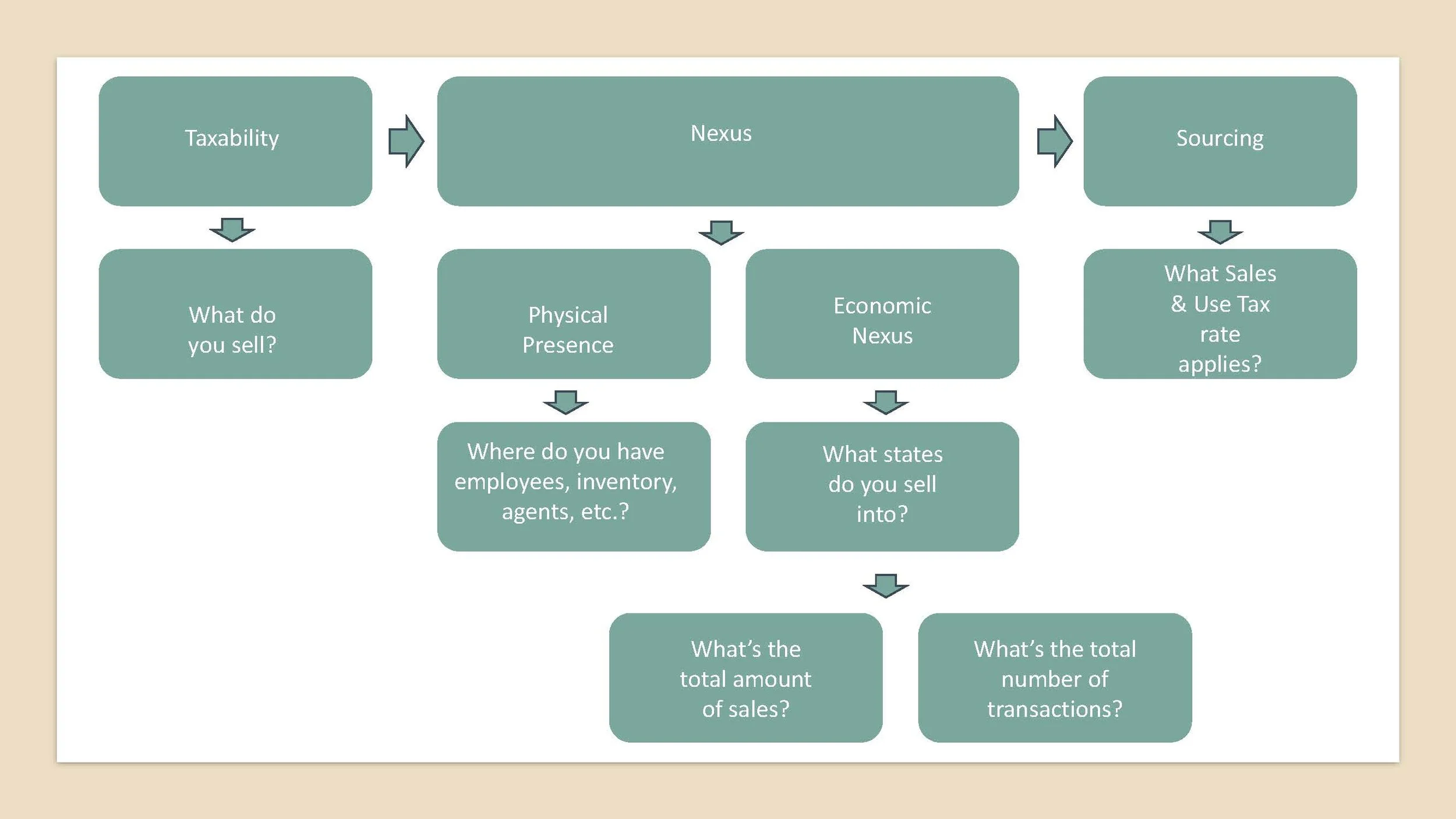

Framework for Understanding Sales Tax

Let’s dive into a framework for understanding and thinking through sales tax. We’ll cover some key concepts and then discuss the logistics involved.

Key Concepts

Taxable Items: Different states and local governments have varying rules on what transactions are taxable. A crucial first step is to determine whether the item you are selling (e.g., goods or services) is subject to sales tax in the relevant jurisdiction.

Nexus: Nexus refers to the connection between a business and a state that obligates the business to collect sales tax. Nexus can be established through:

Physical Presence: For example, having a store, office, warehouse, or employees in the state.

Economic Activity: For example, reaching a certain sales threshold or number of transactions in the state.

Sourcing: Sourcing determines the location where the transaction is considered to have occurred, which in turn dictates the applicable sales tax rate. There are two main types of sourcing:

Origin-Based Sourcing: Sales tax is based on the location of the seller.

Destination-Based Sourcing: Sales tax is based on the location of the buyer.

“Quick Tip #3: In all states that impose sales tax, sales of goods are taxable. Many states do not (yet) impose sales tax on the sale of services. But as technology has developed, the line between goods and services, and so the question of whether sales tax applies, is less clear. ”

Framework

Now that you understand the key concepts, here is a framework to think through and logistical steps to ensure sales tax compliance:

Determine Taxable Items: Identify which of your products or services are taxable in each state where you make sales.

Establish Nexus: Assess your business activities to determine where you have nexus and need to collect sales tax.

Determine Sourcing: Determine sourcing to know where the sale is considered to have taken place so you know what rates to charge. A lot of software will help provide this service.

We’ll do deep dives into each of these topics in the next blogs in this series so keep an eye out for those. For now, let’s talk logistics.

Logistical Steps

Once you know if you need to charge and collect sales tax, you’re probably wondering what that actually looks like.

Register for Sales Tax Permits: Obtain the necessary permits in each state where you have nexus.

Collect Sales Tax: It is the business’s responsibility to collect sales tax from the consumer. Implementing systems to collect the correct amount of sales tax on taxable transactions is incredibly helpful

File and Remit Sales Tax: Once the business has collected the sales tax, it must file a sales tax return and remit (pay over to the correct government authority/office) the sales tax to the appropriate authorities. Depending on your size and amount of sales, you may have annual, quarterly, or monthly filing requirements.

By following this framework, you can navigate the complexities of sales tax and ensure your business remains compliant. If you have any questions or need further assistance, feel free to ask! Look out for our next blog in the series on Sales & Use Tax!

And if you want to see a video presentation we did on this for the Women’s Business Center of Utah you can find it below.